People realize the importance of money as they reach middle age and understand the difficulty of earning it. However, as they enter old age and have a certain amount of savings and retirement funds, the demand for money seems to diminish. Some elderly people even adopt a carefree attitude, believing they should enjoy life while they can. However, reality tells us that throughout our lives, we need to earn and save money.

Regardless of whether someone has a retirement fund, there are several money-saving methods that everyone should learn.

For instance, developing frugal habits can help save money even when finances are tight. It may seem impossible for those who rely on part-time work or farming to make ends meet, but small savings can still be achieved.

One example is Mr. Wan, who accumulated savings without a retirement fund by selling watermelons and raising rabbits. Despite his lack of a regular income, he managed to live within his means by strategically investing his savings, renting out his land, and collecting recyclables. He even managed to have leftover money at the end of the year.

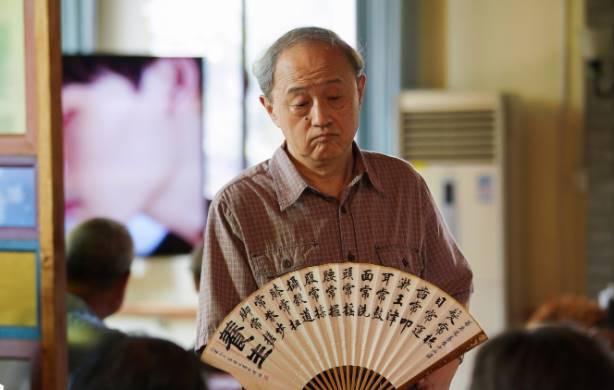

Additionally, it is essential to find ways to earn extra income. Even in old age, there are various opportunities available. Utilizing the internet, elderly individuals can become content creators and monetize their skills. They can showcase their talents, such as making traditional snacks, and sell them online.

Moreover, they can find part-time jobs as security guards, janitors, or dishwashers, earning small amounts of money.

Furthermore, keeping track of expenses and planning for the future is crucial. By maintaining a record of major expenses and having a clear financial plan, misunderstandings among family members can be avoided. It is also essential to differentiate between borrowing money and gift-giving to prevent conflicts within the family.

In conclusion, even though most people aspire to be wealthy, the reality is that the majority will live an ordinary life without significant savings. Therefore, it is important for the elderly to lead a modest lifestyle and consider long-term financial planning. Money should be controlled by individuals rather than controlling their lives. By using money wisely and adopting strategies that involve both earning and saving, elderly individuals can find happiness and financial stability.